Intégration

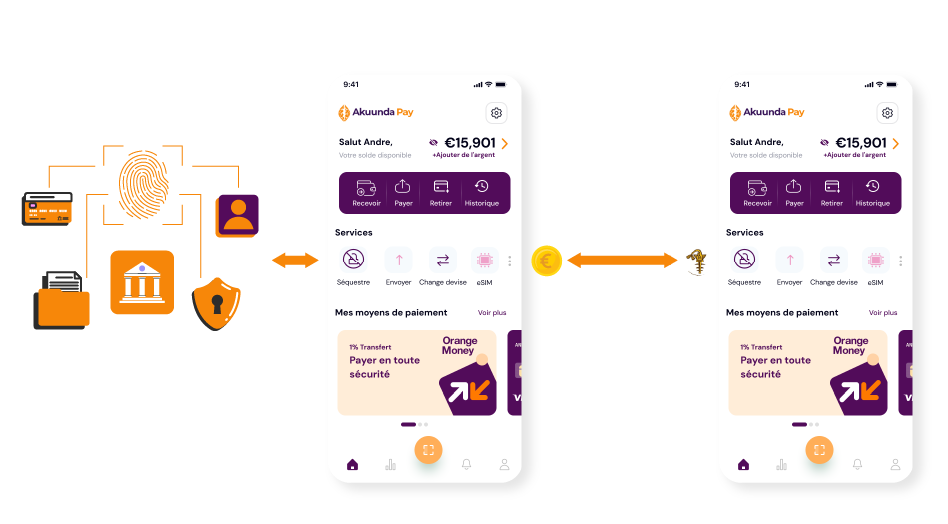

Paiements conditionnels sans banque : l’API et le widget Akuunda Pay permettent d’accepter vos paiements sécurisés sans passer par un intermédiaire bancaire.

Fonction principale : vos paiement en mode séquestre (vos fonds bloqués jusqu’à validation de la prestation)

Génération de liens de paiement : créez rapidement vos demandes de règlement partageables.

- Budgeting: Track income and expenses to manage finances effectively.

- Saving: Build emergency funds and set aside for future goals.

- Investing: Grow wealth through strategic investments.

Caractéristiques principales

+20 Moyens de paiement locaux et internationaux et +160 pays couverts

Permet aux utilisateurs d'envoyer et de recevoir de l'argent facilement via leurs téléphones mobiles.

Establish a Robust Accounting System

Accurate financial data is the foundation of sound decision-making.

Seek Professional Guidance

Engage with financial advisors, accountants, or consultants to gain valuable insights.

Protection contre les fraudes et traçabilité renforcée

Interface intuitive pour des transactions rapides et sans tracas.

Resource Allocation

Effective resource allocation ensures that a company uses its financial resources wisely

Risk Management

This includes having sufficient working capital to cover unforeseen expenses

Solution sans intermédiaire bancaire, réduisant les coûts et les délais

Your burning question, answered

Why should I care about financial planning?

What are the different types of investments?

How can I start saving for retirement?

What is the importance of emergency funds?

What can I use a personal loan for?

What is a personal loan?

What credit score is needed for a personal loan?

How much money can I get a personal loan for?

Garantissez vos paiements transfrontaliers

Télécharger l'Appli

Téléchargez l'application. Elle fonctionne pour IOS et Android.

01

Créer un compte

Ouvrez votre compte en ligne sécurisée.

02

Faire ses transactions

Transformez chaque transaction en une expérience sécurisée et améliorée.