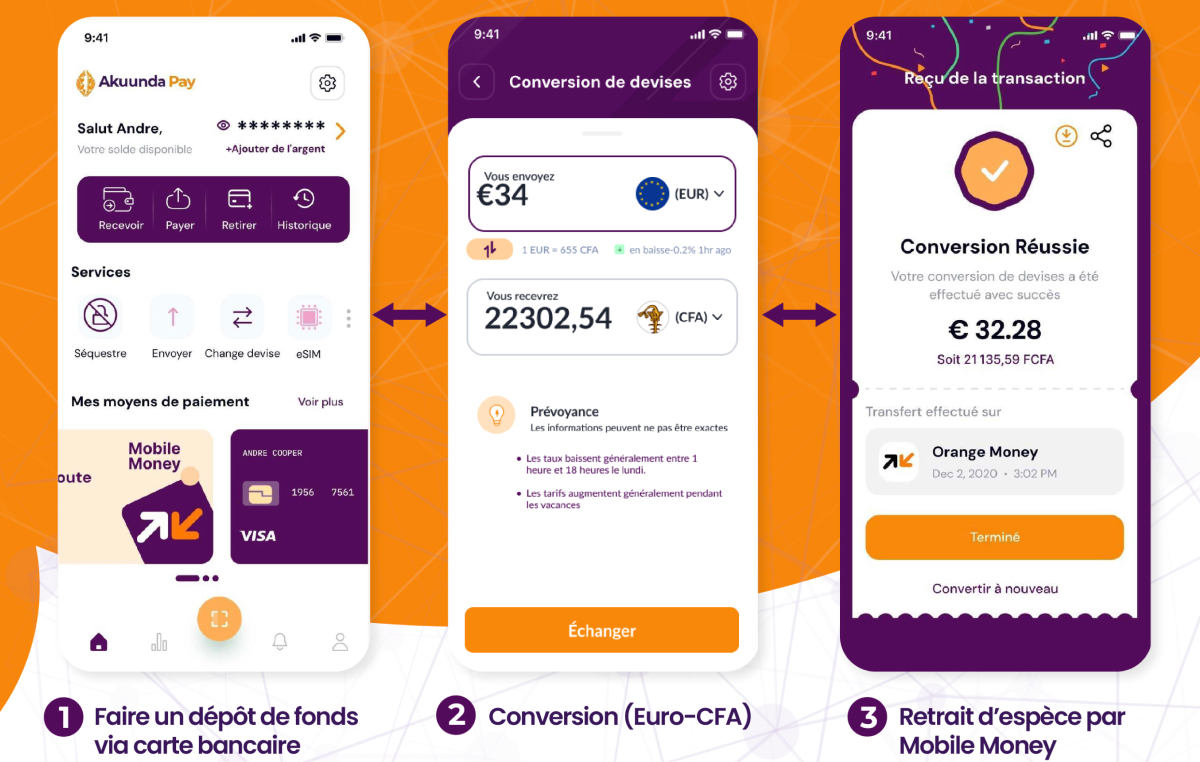

Changes de Devises

Dépôt par carte bancaire (ou autre) : lors de vos voyages en Afrique, alimentez votre compte Akuunda Pay directement depuis votre carte.

Conversion instantanée : changez vos devises étrangères (EUR, USD, etc.) en monnaie locale (FCFA, NGN, etc.) via Akuunda Pay.

Retrait sécurisé via Mobile Money : retirez vos fonds en espèces dans un point de vente Mobile Money.

- Budgeting: Track income and expenses to manage finances effectively.

- Saving: Build emergency funds and set aside for future goals.

- Investing: Grow wealth through strategic investments.

Caractéristiques principales

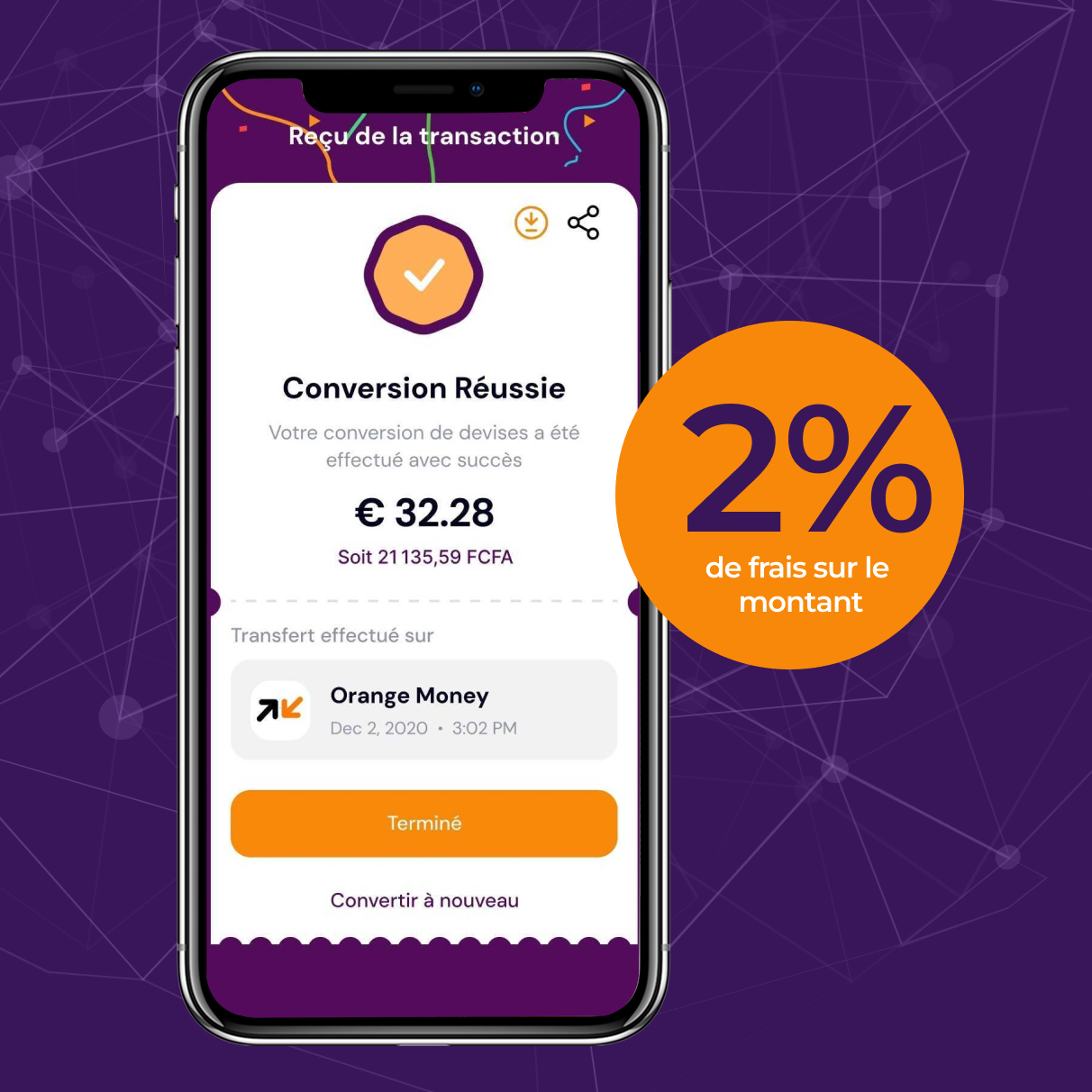

Frais compétitifs

Des frais de change transparents

et compétitifs, souvent inférieurs à ceux

des services de change traditionnels.

Establish a Robust Accounting System

Accurate financial data is the foundation of sound decision-making.

Seek Professional Guidance

Engage with financial advisors, accountants, or consultants to gain valuable insights.

Taux de change en temps réel

Utilisation des taux de change actuels pour garantir des conversions précises et justes.

Resource Allocation

Effective resource allocation ensures that a company uses its financial resources wisely

Risk Management

This includes having sufficient working capital to cover unforeseen expenses

Intégration fluide

Les services de change sont intégrés directement dans la plateforme, permettant des transactions transparentes et sans interruption.

Establish a Robust Accounting System

Accurate financial data is the foundation of sound decision-making.

Seek Professional Guidance

Engage with financial advisors, accountants, or consultants to gain valuable insights.

Your burning question, answered

Why should I care about financial planning?

What are the different types of investments?

How can I start saving for retirement?

What is the importance of emergency funds?

What can I use a personal loan for?

What is a personal loan?

What credit score is needed for a personal loan?

How much money can I get a personal loan for?

Garantissez vos paiements transfrontaliers

Télécharger l'Appli

Téléchargez l'application. Elle fonctionne pour IOS et Android.

01

Créer un compte

Ouvrez votre compte en ligne sécurisée.

02

Faire ses transactions

Transformez chaque transaction en une expérience sécurisée et améliorée.